Munis pare back some losses; fund flows stay in positive territory

Municipals saw gains Thursday, ending four consecutive trading sessions of rising yields. U.S. Treasuries improved and equities ended mixed.

Municipal yields fell up to seven basis points, depending on the scale, while UST yields fell one to five basis points.

Muni-UST ratios fell slightly. The two-year ratio Thursday was at 66%, the three-year at 65%, the five-year at 66%, the 10-year at 72% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 67%, the three-year at 66%, the five-year at 66%, the 10-year at 72% and the 30-year at 85% at 3:30 p.m.

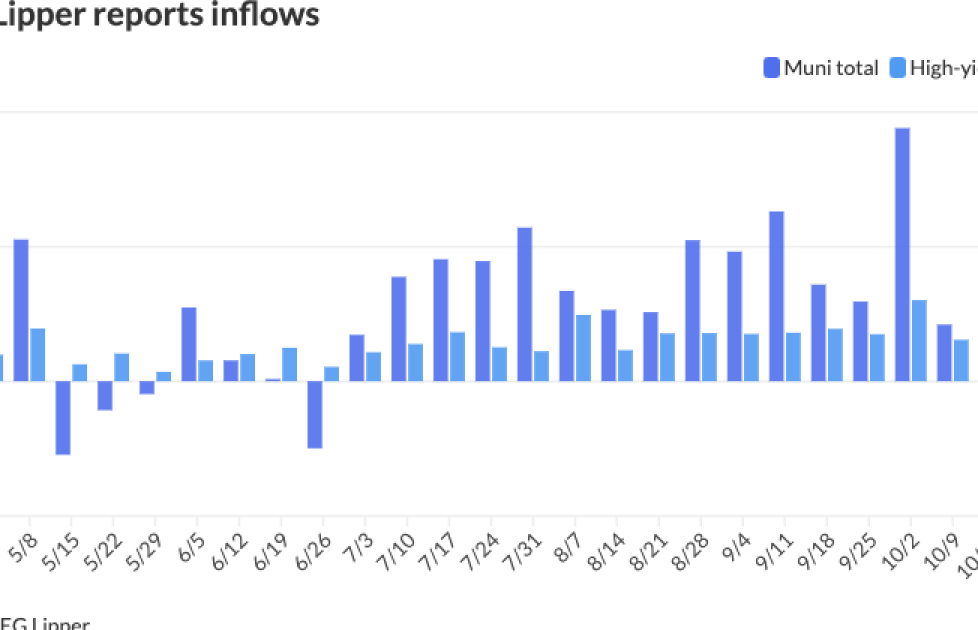

High-yield funds saw inflows of $271.8 million, up from $36.2 million the week prior.

Inflows into muni mutual funds stem, in part, from returns.

Market participants chase returns, which were positive June through September. Returns have been negative in October, with munis seeing losses of 1.88%, pushing year-to-date returns lower to 0.37%.

Returns have “backed up” a little bit month-to-date, said Sheila May, director of municipal bond research at GW&K Investment Management.

With the “supersized” Fed rate cut in September, there was the expectation the Fed would cut rates two more times, each by 25 basis points, before the end of the year, she said.

However, that is “off the table” following strong employment reports and spending, she noted.

“There’s been a little bit of give back based on recent prints economic prints,” May said.

However, returns month-to-date are not “significantly negative,” and the four previous months of positive returns have led people to put money back into the muni market, said Jeff Timlin, a partner at Sage Advisory.

While fundamentals remain strong — with credit upgrades outpacing downgrades by 3.5 times so far in 2024 — technical factors have been “less supportive,” Principal Asset Management strategists said in a report.

Issuance is at $418.451 billion year-to-date, up 41.1%, according to LSEG data.

The surge in supply this year is due to inflation “getting under control,” rates coming down and drying up federal aid that has led to states and local governments to issue in the muni market, May said.

May expects that momentum to continue, especially given the scope of infrastructure needs.

“Infrastructure issuance in the safe sectors and hospitals and higher education bonds for the risky sectors” has contributed to the growth in supply year-over-year, said Matt Fabian, a partner at Municipal Market Analytics.

“And this uptick in bond sales may not be just an opportunistic, pre-election bump but rather a more durable driver of future issuance necessary to address the significant backlog of deferred maintenance in these sectors (and others), estimated at $1.2 trillion for water utilities and roughly $1 trillion for higher education,” Fabian said, citing Pew and Moody’s data.

Overall, the influx in issuance is helped by several weeks of supply topping $10 billion.

There was an “abundance” of supply last week, which has no problem being “gobbled up,” Timlin said.

The deals that have offered “some additional income spread” have seen decent interest, he noted.

And with a robust slate of deals this week and several large deals on tap next week, 2024 may see record issuance, Timlin said.

Supply may slow following Nov. 5 but deals will still be on the calendar as issuers want to come to market ahead of the Thanksgiving and Christmas holidays, he said.

However, the surge in supply has led to “further cheapening as a result of substantial net supply, election-related uncertainty, and other market dynamics,” Principal Asset Management strategists said.

In the primary market Thursday, Goldman Sachs priced for Intermountain Power Agency, Utah, (Aa3//AA-/) $161.215 million of tax-exempt power supply revenue bonds, 2024 Series A, with 5s of 7/2026 at 2.96%, 5s of 2029 at 2.90%, 5s of 2034 at 3.31%, 5s of 2039 at 3.58%, 5s of 2044 at 3.94% and 5s of 2045 at 3.99%, callable 7/1/2033.

BofA Securities priced for the Maryland Health and Higher Educational Facilities Authority (A1/A+//) $117.44 million of Lifebridge Health Issue revenue bonds, with 5s of 7/2049 at 4.34%, 5s of 2054 at 4.38% and 5.25s of 2054 at 4.33%, callable 7/1/2034.

Money market funds sess inflows

Tax-exempt municipal money market funds saw inflows as $1.58 billion was added the week ending Tuesday, bringing the total assets to $1231.22 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds rose to 3.28%.

Taxable money-fund assets saw $53.67 billion added to end the reporting week.

The average seven-day simple yield for all taxable reporting funds remained at 4.54%.

The SIFMA Swap Index, meanwhile, fell to 3.51% Wednesday compared to the previous week. This is down 51 basis points from two weeks ago when it was at 4.02%.

AAA scales

Refinitiv MMD’s scale was bumped two to seven basis points: The one-year was at 2.86% (-7) and 2.68% (-7) in two years. The five-year was at 2.67% (-7), the 10-year at 3.03% (-4) and the 30-year at 3.89% (-5) at 3 p.m.

The ICE AAA yield curve was narrowly mixed: 2.95% (-1) in 2025 and 2.73% (-1) in 2026. The five-year was at 2.69% (-1), the 10-year was at 3.02% (+1) and the 30-year was at 3.82% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped: The one-year was at 2.90% (-6) in 2025 and 2.71% (-4) in 2026. The five-year was at 2.70% (-4), the 10-year was at 2.99% (-4) and the 30-year yield was at 3.82% (-5) at 3 p.m.

Bloomberg BVAL saw bumped three to six basis points: 2.82% (-5) in 2025 and 2.64% (-5) in 2026. The five-year at 2.67% (-4), the 10-year at 2.99% (-3) and the 30-year at 3.84% (-6) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.073% (-1), the three-year was at 4.014% (-2), the five-year at 4.027% (-3), the 10-year at 4.207% (-4), the 20-year at 4.548% (-5) and the 30-year at 4.469% (-5) at the close.