Muni market sees sharp correction in selloff

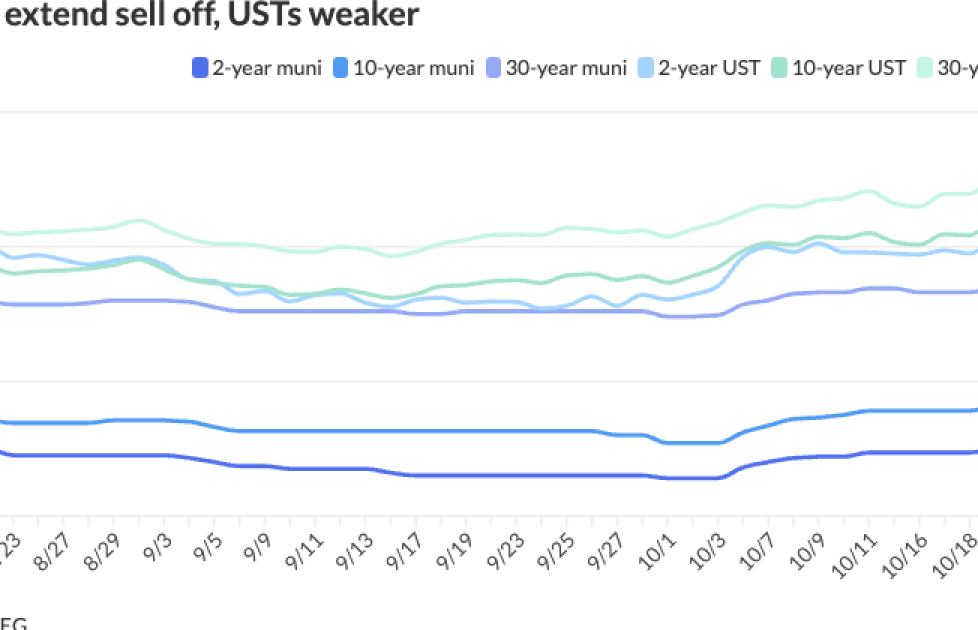

Municipals saw a sharp correction Wednesday, with yields rising double-digits as the asset class played catch up to U.S. Treasuries after recent outperformance led to too-rich ratios. Deals in the primary repriced to higher yields as a result.

Muni yields rose five to 18 basis points, depending on the scale, pushing the 10-year above 3% for the first time since early July. UST yields rose one to five basis points.

Muni-UST ratios rose. The two-year ratio Wednesday was at 67%, the three-year at 67%, the five-year at 68%, the 10-year at 72% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 68%, the three-year at 67%, the five-year at 67%, the 10-year at 72% and the 30-year at 85% at 3:30 p.m.

USTs have been on a “one-way trade up in yield” for several weeks, though munis have ignored that a bit, including last week, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

Ideally, there would have been some trades to support moves along the way last week instead of muni yields being cut double digits on Wednesday, she said.

The rout, Olsan said, “is all about correcting ratios.”

“If you look at the broad metrics, bid wanted count going up, dealer inventory going up week after week, money market balances going up … [meaning] some amount of money is hanging in cash and not getting invested, then supply at its level, it’s all bearish for performance,” Olsan added.

Other macroeconomic and political factors have rattled markets overall. Treasury rates “have spiked sharply as a Republican election win looks more likely, raising concerns about deficit spending and inflation,” said James Pruskowski, chief investment officer at 16Rock Asset Management.

This shift has “stirred uncertainty, softening secondary liquidity in the muni market,” he said.

The increased probability of a Republican victory has led to an acceleration in supply as “issuers rush to secure funding amid policy uncertainty,” Pruskowski said.

“Coming off rich muni-Treasury ratios, the market has swiftly repriced,” he said. “With now cheaper benchmark yields and wider credit spreads, fresh capital is flowing in, and a strong bottoming opportunity looks to be emerging.”

“It is not particularly surprising to see tax-exempt rates reset higher in sympathy with earlier moves in the UST market, particularly given expected heavy supply this week and next, and amid near annual lows in reinvestment capital,” said J.P. Morgan strategists, led by Peter DeGroot, in a report.

A continued selloff in USTs will put some more pressure on muni yields to “go a bit higher,” as ratios have been in fair to rich territory and the flurry of deals coming to market will need to price according to more attractive levels, said Jeff Timlin, a partner at Sage Advisory.

The Investment Company Institute reported $1.524 billion of

This marks 11 consecutive weeks of inflows and six straight weeks of inflows topping $1 billion.

Exchange-traded funds saw $1.205 billion of inflows after $252 million of outflows the previous week.

In the primary market Wednesday, Siebert Williams Shank priced for institutions $1.5 billion of future tax-secured subordinate bonds, Fiscal 2025 Series D, from the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with large cuts from Tuesday’s retail pricing: 5s of 2026 at 2.93% (+17), 5s of 2029 at 2.88% (+17), 5s of 2034 at 3.34% (+16), 5s of 2039 at 3.67% (+18), 5s of 2044 at 4.03% (+15) and 4.25s of 2054 at 4.45% (+5).

J.P. Morgan priced for the Ohio Housing Finance Agency (Aaa///) $275 million of residential mortgage non-AMT social revenue bonds, with 3.25s of 9/2025 at par, 6s of 3/2029 at 3.20%, 6s of 9/2029 at 3.22%, 5s of 3/2024 at 3.71%, 3.95s of 9/2034 at par, 4.1s of 9/2039 at par, 4.5s of 9/2044 at pat, 7.5s of 3/2049 at 4.23%, 4.65s of 9/2049 at par, 4.7s of 9/2054 at par and 6.25s of 3/2055 at 3.81%, callable 3/1/2034.

Morgan Stanley priced for the Regents of the University of Colorado (Aa1//AA+/) $221.685 million of university enterprise refunding revenue bonds, Series 2024A, with 5s of 6/2025 at 3.45%, 5s of 6/2029 at 2.91% and 5s of 10/2030 at 3.00%, noncall.

Jefferies priced for North Slope Borough, Alaska, (/AA/AA/AA+/) $128.745 million of GOs. The first tranche, $104.085 million of general purpose bonds, Series 2024A, saw 5s of 6/2025 at 3.35%, 5s of 2029 at 2.91%, 5s of 2034 at 3.47% and 5s of 2036 at 3.58%, callable 6/30/2032.

The second tranche, $24.66 million of school bonds, Series 2024B, saw 5s of 6/2025 at 3.35%, 5s of 2029 at 2.91%, 5s of 2034 at 3.47% and 5s of 2036 at 3.58%, callable 6/30/2032.

In the competitive market, St. Johns County, Florida, (Aaa/AA+//) sold $105.17 million of special obligation revenue bonds, Series 2024A, to Jefferies, with 5s of 10/2025 at 3.15%, 5s of 2029 at 2.81%, 5s of 2034 at 3.22%, 5s of 2039 at 3.60% and 5s of 2044 at 3.95%, callable 10/1/2034.

AAA scales

Refinitiv MMD’s scale saw large cuts outside of one year: The one-year was at 2.93% (+5) and 2.75% (+18) in two years. The five-year was at 2.74% (+18), the 10-year at 3.07% (+15) and the 30-year at 3.94% (+15) at 3 p.m.

The ICE AAA yield curve was cut 10 to 14 basis points in spots: 2.96% (+10) in 2025 and 2.74% (+14) in 2026. The five-year was at 2.70% (+14), the 10-year was at 3.01% (+12) and the 30-year was at 3.82% (+12) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut eight to 17 basis points: The one-year was at 2.96% (+8) in 2025 and 2.75% (+13) in 2026. The five-year was at 2.74% (+17), the 10-year was at 3.03% (+14) and the 30-year yield was at 3.87% (+13) at 3 p.m.

Bloomberg BVAL saw large cuts outside of one year: 2.87% (+7) in 2025 and 2.69% (+14) in 2026. The five-year at 2.70% (+17), the 10-year at 3.02% (+18) and the 30-year at 3.90% (+15) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.077% (+4), the three-year was at 4.028% (+5), the five-year at 4.049% (+4), the 10-year at 4.237% (+3), the 20-year at 4.588% (+3) and the 30-year at 4.511% (+1) at the close.

Primary to come

The California Community Choice Financing Authority is set to price this week $1.125 billion of Clean Energy Project green revenue bonds, Series 2024D. RBC Capital Markets.

The Virginia Small Business Financing Authority (//BBB/) is set to price Thursday $166.685 million of revenue bonds, consisting of $143.665 million of Series 2024A, $9.48 million of Series B-1 entrance fee redemption bonds and $13.54 million of Series B-2 entrance fee redemption bonds. HJ Sims.

The Conroe Independent School District, Texas, (Aaa/AAA//) is set to price Thursday $129.49 million of PSF-insured unlimited tax refunding bonds, serials 2026-2036. Jefferies.

The Maryland Health and Higher Educational Facilities Authority (A1/A+//) is set to price Thursday $117.015 million of Lifebridge Health Issue revenue bonds, terms 2049, 2054. BofA Securities.

The Intermountain Power Agency, Utah, (Aa3//AA-/) is set to price Thursday $114.62 million of tax-exempt and taxable power supply revenue bonds. Goldman Sachs.

The Ohio Water Development Authority (/AAA//) is set to price Thursday $102.02 million of Fresh Water Revolving Fund water development refunding revenue bonds, serial 2025-2042. Jefferies.