Muni yields fall, DASNY accelerates $1B+ Northwell Health into busy primary

Municipals yields fell Tuesday following the U.S. Treasury market in a flight-to-safety bid amid rising tensions in the Middle East while equities saw losses. The larger new-issue slate began pricing in earnest as the Dormitory Authority of the State of New York accelerated a $1-plus billion Northwell Health deal and several competitive loans were well bid.

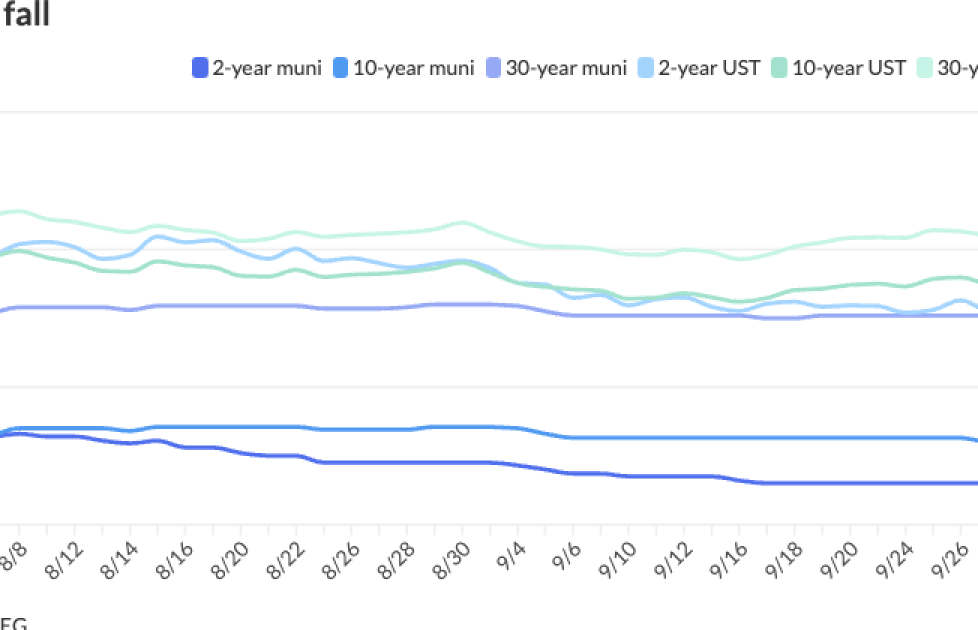

Muni yields were bumped up to six basis points, depending on the scale, while UST yields fell four to six basis points.

The two-year muni-to-Treasury ratio Tuesday was at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 86%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 63%, the five-year at 63%, the 10-year at 68% and the 30-year at 84% at 3:30 p.m.

The muni bond market remains well bid, as “it drafts on the strength of the Treasury market,” said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

The muni market has “absorbed” the outsized new issuance, which will continue for the next few weeks, they said.

The larger supply calendar should be “taken down well given the persistent inflows into our market and investors are still sitting on plenty of cash,” said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

As the third quarter came to a close Monday, it was a “strong quarter across all segments of the market,” Clements said.

Munis returned 2.71% for the third quarter. High yield saw positive returns of 3.21% and taxables saw gains of 5.42% in Q3.

“The yield curve began to normalize, and credit continued to outperform,” Clements said.

However, the technical picture was more mixed as both supply and demand remained robust, he said.

“This demand has been critical in helping to offset the tsunami of issuance this year,” Clements said.

Net supply for October is expected to be large at $15 billion, Clements said.

“However, as has been the case this year, continued demand for tax-exempt income should help mitigate elevated net supply,” he said.

Net supply for November and December will be negative $8 billion and negative $3 billion, respectively, according to Clements.

“Municipal valuations tend to correlate closely with net supply; when net supply is negative, the market tends to outperform,” he said. “Combine that strong technical environment with a Fed continuing to cut rates and historically high yields, and you have a recipe for some muni market cooking.”

In the primary market Tuesday, Morgan Stanley accelerated a pricing for the Dormitory Authority of the State of New York (A3/A-/A-/) $1.117 billion of Northwell Health Obligated Group revenue bonds. The first tranche, $763.205 million of Series 2024A bonds, saw 5s of 5/2034 at 2.98%, 4s of 2039 at 3.60%, 4s of 2054 at 4.19% and 5.25s of 2054 at 3.92%, callable 5/1/2034.

The second tranche, $353.31 million of forward delivery Series 2025A bonds, saw 5s of 5/2026 at 2.63%, 5s of 2029 at 2.71%, 5s of 2034 at 3.06%, 5s of 2037 at 3.20% and 5s of 2043 at 3.66%, callable 5/1/2034.

Wells Fargo Bank priced for the Pennsylvania Turnpike Commission (A2/A+/A/A+) $585.14 million of turnpike subordinate revenue refunding bonds, First Series of 2024, with 5s of 12/2025 at 2.70%, 5s of 12/2029 at 2.57%, 5s of 6/2034 at 2.99%, 5s of 12/2034 at 2.99%, 5s of 12/2039 at 3.26% and 5s of 12/2043 at 3.53%, callable 12/1/2034.

BofA Securities priced for Colorado (Aa2/AA-//) $252.12 million of Higher Education Health Sciences Facilities certificates of participation, Series 2024A, with 5s of 11/2027 at 2.37%, 5s of 2029 at 2.40%, 5s of 2034 at 2.85%, 5s of 2039 at 3.17%, 5s of 2044 at 3.55%, 4s of 2049 at 4.05%, 5s of 2049 at 3.81%, 54s of 2053 at 4.09% and 5s of 2053 at 3.86%, callable 11/1/2034.

BofA Securities priced for Tampa, Florida, (Aaa/AAA/AAA/)

BofA Securities priced for the Timpanogos Special Service District, Utah, (/AA/AA+/) $214.4million of sewer revenue and refunding bonds, Series 2024, with 5s of 6/2025 at 2.87%, 5s of 2029 at 2.41%, 5s of 2034 at 2.78%, 5s of 2039 at 3.05%, 5s of 2044 at 3.44%, 5s of 2049 at 3.67% and 5s of 2054 at 3.78%, callable 12/1/2034.

In the competitive market, the

The second tranche, $171.725 million of climate certified Series 2024B-2 bonds, saw 5s of 11/2046 at 3.57% and 5s of 2048 at 3.65%, callable 11/15/2034.

The authority also sold $396.26 million of dedicated tax fund refunding green climate certified bonds, Series 2024B, Bidding Group 2, to Wells Fargo, with 5s of 11/2049 at 3.71% and 4s of 2054 at 4.07%, callable 11/15/2034.

Minneapolis, Minnesota, (/AAA/AAA/) sold $123.59 million of GOs to Jefferies, with 5s of 12/2024 at 3.00%, 5s of 2029 at 2.36%, 5s of 2034 at 2.65%, 4s of 2039 at 3.25% and 3s of 2043 at 3.85%, 3.78%, callable 12/1/2033.

The Virginia Transportation Board (Aa1/AA+/AA+/) sold $119.61 million of federal transportation grant anticipation revenue notes to Morgan Stanley, with 5s of 3/2025 at 3.15%, 5s of 3/2029 at 2.37%, 5s of 9/2029 at 2.37%, 5s of 3/2034 at 2.68%, 5s of 9/2034 at 2.69% and 5s of 9/2039 at 2.98%, callable 9/15/2034.

AAA scales

Refinitiv MMD’s scale was bumped up to six basis points: The one-year was at 2.55% (unch, no Oct. roll) and 2.28% (-2, no Oct. roll) in two years. The five-year was at 2.27% (-4, no Oct. roll), the 10-year at 2.54% (-6, no Oct. roll) and the 30-year at 3.48% (-4) at 3 p.m.

The ICE AAA yield curve was bumped up to five basis points: 2.56% (unch) in 2025 and 2.30% (-2) in 2026. The five-year was at 2.26% (-5), the 10-year was at 2.55% (-5) and the 30-year was at 3.45% (-5) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped one to five basis points: The one-year was at 2.54% (-1) in 2025 and 2.29% (-3) in 2026. The five-year was at 2.27% (-5), the 10-year was at 2.56% (-5) and the 30-year yield was at 3.45% (-5) at 3 p.m.

Bloomberg BVAL was bumped outside of one-year: 2.54% (+5) in 2025 and 2.35% (-2) in 2026. The five-year at 2.31% (-4), the 10-year at 2.57% (-4) and the 30-year at 3.44% (-4) at 3:30 p.m.

Treasuries saw gains.

The two-year UST was yielding 3.608% (-4), the three-year was at 3.519% (-5), the five-year at 3.514% (-6), the 10-year at 3.739% (-6), the 20-year at 4.141% (-5) and the 30-year at 4.078% (-4) at the close.

Primary to come:

The Kentucky State Property and Buildings Commission (Aa3//AA-/) is set to price Wednesday $600 million of Project No. 131 revenue bonds, serials 2025-2044. BofA Securities.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price Wednesday $494.905 million of social single-family mortgage revenue bonds, consisting of $300.2 million of non-AMT bonds, Series 2024D, serials 2025-2036, terms 2039, 2044, 2049, 2055, 2055; $144.705 million of taxables, Series 2024E, serials 2025-2034, terms 2039, 2044, 2049, 2055; and $50 million of taxables, Series 2024F. RBC Capital Markets.

Massachusetts (Aa1/AAA//AAA/) is set to price Wednesday $490.7 million of Commission Transportation Fund revenue bonds, consisting of $150 million of Rail Enhancement Program bonds, Series 2024A, serials 2044, 2047-2053; $125 million of sustainability Rail Enhancement Program bonds, Series 2024B, term 2054; and $215.7 million of refunding bonds, Series 2024A, serials 2025-2037, term 2044. BofA Securities.

The Trustees of Columbia University (Aaa/AAA//) is set to price Wednesday $350 million of taxable corporate CUSIPs. Goldman Sachs.

San Antonio, Texas, (Aa1/AA+/AA/) is set to price Thursday $268.59 million of water system junior lien revenue bonds, Series 2024B. J.P. Morgan.

The National Finance Authority (/A//) is set to price Wednesday $179.065 million of affordable housing social certificates, Series 2024-1 Class A. Wells Fargo.

The IPS Multi-School Building Corp., Indiana, (Aa2/AA+//) is set to price Wednesday $167.76 million of ad valorem property tax first mortgage refunding and improvement social bonds, serials 2025-2044, term 2046, Indiana State Aid Intercept Program. Stifel.

The Northeast Ohio Regional Sewer District (Aa1/AA+//) is set to price Wednesday $163.105 million of wastewater improvement refunding revenue bonds, Series 2024, serials 2025-2044, term 2046. Jefferies.

The Dormitory Authority of the State of New York is set to price Wednesday $150 million of Columbia University revenue bonds, Series 2024A. BofA Securities.

Santa Clara, California, (/AA-/AA-/) is set to price Wednesday $113.56 million of Silicon Valley Power electric revenue bonds. J.P. Morgan.

Competitive:

Alexandria, Virginia, is set to sell $114.92 million of GO capital improvement bonds at 10:30 a.m. eastern Thursday.