Munis ignore UST weakness following Fed cut

Municipals were steady Wednesday ignoring the volatility in U.S. Treasuries and equities, which whipsawed following the Federal Reserve’s 50-basis point rate cut, before both closing the session weaker.

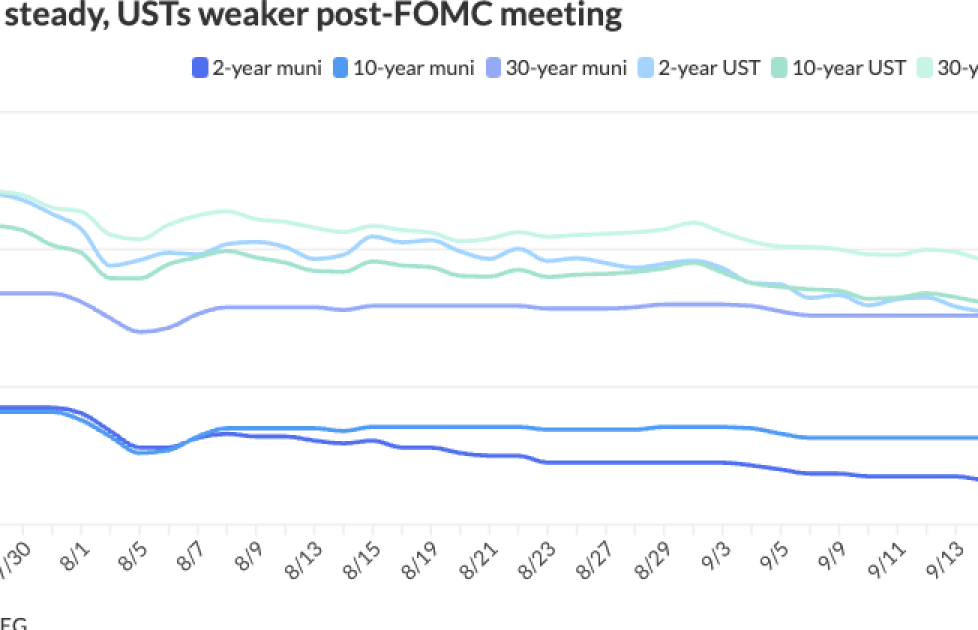

Municipal triple-A yields were little changed while USTs closed the session weaker by to eight basis points out long.

For municipals, Wednesday “marks a crucial step forward, perfectly aligned with the current risk landscape,” said James Pruskowski, chief investment officer for 16Rock Asset Management.

With elevated muni-UST ratios and strong inflows into munis, the asset class is in an “excellent position to absorb a surge in new issuance,” he said.

The two-year muni-to-Treasury ratio Wednesday was at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 72% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 71% and the 30-year at 88% at 4 p.m.

“The narrative is incredibly supportive, and robust retail demand only strengthens the case for municipals,” Pruskowski said.

Following the announcement of a half-point rate cut, markets were “skittish,” as equities and U.S. Treasuries oscillated up and down, said Anthony Tanner, a research analyst and market strategist.

“Stocks and bonds rallied initially, but have given up some of the gains,” said Andrzej Skiba, managing director and head of U.S. Fixed Income at RBC Global Asset Management.

The 10-year UST is above 3.70% and the 30-year is above 4%. The market should trade a little bit weaker, presenting a buying opportunity for investors in the long run, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

“The setup for this meeting was not ideal,” said Christian Hoffmann, head of fixed income at Thornburg Investment Management.

With the market participants evenly split between a 25- or 50-basis-point cut, “hopes were bound to be dashed,” he said.

“On top of that, U.S. equity indices rallied nearly every day last week and are flirting with all-time highs and elevated valuations, along with benchmark Treasury rates touching lows for the year,” Hoffmann said.

Both Brigati and Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities, expected 25-basis-point rate cuts.

The Fed has been “telegraphing” a quarter-point rate cut for so long that Brigati thought a half-point rate cut “would signal that there’s more concern for the economy and the labor market than [the Fed] would have wanted to admit.”

With the half-point rate cut, it reinforces Kozlik’s message to investors over the past several months: they should be regularly getting into fixed income, specifically tax-exempt munis, and not waiting, he said,

If investors wait too long, rates will be lower and the options for investing will not be as “plentiful,” Kozlik said.

Tanner said he would not characterize a 50-basis-point rate cut as “a big move,” not in the context of the Fed implementing four 75-basis-point rate hikes over five months in 2022.

“On other occasions, the rate cuts have been much larger and faster,” Tanner said.

This was the first time the Fed cut rates since 2020, bringing some “uncertainty” where muni yields may be over the next several months, said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

The muni curve saw “increased volatility” during three, 25-basis-point cuts that started in July 2019, she said.

Thirty days after the first rate cut on July 31, 2019, the 10-year MMD spot rallied 30 basis points, but between Aug. 31, 2019, and Sept. 18, 2019 — ahead of the second rate cut — the 10-year spot gave back 100% of the rally, Olsan said.

Supply for the month was at $37 billion — “not an outsized number but about 25% higher than prior years,” she said.

Between Sept. 18, 2019 and Oct. 30, 2019, at the last cut of that year, the 10-year MMD yield “traded from 1.51% to 1.29% and then ended the month at 1.55% — essentially rallying twice and giving it back twice,” she said.

By the end of 2019, the 10-year MMD yield closed at 1.44%, she said.

“It is quite likely the level of supply through the end of this year will be a defining factor for rate direction,” Olsan said.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.50% and 2.30% in two years. The five-year was at 2.31%, the 10-year at 2.63% and the 30-year at 3.50% at 3 p.m.

The ICE AAA yield curve was narrowly mixed: 2.49% (-2) in 2025 and 2.30% (-3) in 2026. The five-year was at 2.30% (-1), the 10-year was at 2.57% (unch) and the 30-year was at 3.48% (+1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.49% (+2) in 2025 and 2.32% (unch) in 2026. The five-year was at 2.33% (unch), the 10-year was at 2.58% (unch) and the 30-year yield was at 3.48% (unch) at 3 p.m.

Bloomberg BVAL was little changed: 2.43% (unch) in 2025 and 2.37% (unch) in 2026. The five-year at 2.36% (unch), the 10-year at 2.59% (unch) and the 30-year at 3.47% (-1) at 4 p.m.

Treasuries were better.

The two-year UST was yielding 3.606% (+3), the three-year was at 3.507% (+6), the five-year at 3.499% (+6), the 10-year at 3.718% (+7), the 20-year at 4.100% (+7) and the 30-year at 4.035% (+8) at 4 p.m.

FOMC

The Federal Open Market Committee cut the fed funds rate target by 50 basis points to a range between 4.75% and 5%, with the Summary of Economic Projections expecting two more cuts this year and four next year.

The move, the first cut since March 16, 2020, was made “in light of the progress on inflation and the balance of risks,” according to the post-meeting statement.

“The Committee has gained greater confidence that inflation is moving sustainably toward 2%, and judges that the risks to achieving its employment and inflation goals are roughly in balance,” the statement added. “The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.”

The vote was 11-1, with Gov. Michelle Bowman voting against a half-point cut, preferring a 25-basis point reduction.

In his press conference, Fed Chair Jerome Powell said, “we now see the risks to achieving our employment goals as roughly in balance.”

“We do not think we’re behind,” he said, “I think you can take this as a sign of our commitment not to get behind.”

When asked about the purpose of a large cut, Powell said, “the economy is in a good place and our intention is to keep it there.” He stopped short of declaring victory over inflation.

At yearend, nine officials expect the fed funds target rate at a range between 4.25% and 4.50%, with seven expecting between 4.50% and 4.75%. For next year, six members each see a range between 3.25% and 3.50% and 3.00% and 3.25%.

There is no consensus on the longer-term rate, with no more than three officials agreeing on any number and the projections ranging from a low of 2.375% and a high of 3.75%. The median long-term neutral rate is 2.9%, which the SEP projects will be reached in 2026.

“This is a bit of a surprise,” said Fitch Rating Chief Economist Brian Coulton. “The 50 bp cut suggests an abrupt switch of focus back to the maximum employment mandate and a very sharp improvement in confidence in inflation progress in the last month and a half. The latter is a little hard to understand given the incoming inflation data and it suggests that the Fed may be more concerned than most about the state of the labor market, where the pace of job creation still looks pretty solid.”

“The Fed comes in strong with a large rate cut, while trying to reassure the economic outlook is strong,” said Giuseppe Sette, president and co-founder of Toggle AI. “But the two facts don’t jive well together. Be careful, a big rate cut in a slowing environment has always preceded a market drop. It’s possible we’ve seen the peak of the market today.”

Because the economy remains strong despite slowing, Nancy Tengler, CEO and CIO of Laffer Tengler Investments, said, “I think the Fed may have jumped the gun at 50 bps.”

While it’s possible unemployment will grow, she said, “we are not seeing layoffs — JOLTs still a very large number, well above pre-pandemic levels.”

The move seems like “a myopic focus on backward looking data,” Tengler said. “A single weak employment report and here we are.”

“This larger-than-usual reduction reflects the Fed’s belief that inflation is now within manageable levels as it continues its push towards the 2% target,” said Richard Flax, chief investment officer at Moneyfarm.

The size of the reduction, and those of the next couple of meetings “doesn’t matter much for the real economy,” said Gal Krubiner, co-founder and CEO of Pagaya. “The expectation is what matters, and the fact is that rates going down creates favorable conditions for both consumers and financial institutions.”

Still, the big issue is where the Fed stops — “whether 3.5% or 2.5%,” Krubiner said.

The FOMC “wants to get to neutral quickly as it increasingly prioritizes potential jobs weakness at a time when they are more comfortable with the inflation backdrop, said ING Chief International Economist James Knightley. “We look for a further 150bp of cuts by next summer, but the risks are skewed towards them doing more.”

Bowman’s dissention, the first since 2005, “signals to me that this meeting’s debate was contentious,” said Thornburg Investment Management’s Hoffmann. “This meeting’s minutes will be a compelling read when they are published in a few weeks.”

The concerns for the FOMC, he said, must be “not just about doing too much versus too little, but also concerns about signaling to markets, and perhaps more subtly, political optics and legacy considerations.”

Byron Anderson, head of fixed income at Laffer Tengler Investments, said the half-point cut “gives the Fed breathing room.”

Bond markets expecting a total of 250 bp of cuts over the next year, he said, but “if the economy stays healthy, I believe rate cuts should be shallower than markets expect and that means long end rates will drift higher.”

BMO Deputy Chief Economist Michael Gregory said, “the reason for the large start was clear in the policy statement … inflation had improved, and the labor market had deteriorated sufficiently to warrant a bigger (than 25 bp) action.”

Jack McIntyre, portfolio manager at Brandywine Global, said the Fed was in “catch up mode.” He added, “Powell knows they should have moved 25bps in July, so add in 25bps at this meeting and you get to the 50bps rate cut.”

With greater confidence on inflation and a “strong commitment to maximum employment shows that a more prolonged and predictable easing cycle is at hand.”

Lauren Saidel-Baker, an economist with ITR Economics, said, “While an initial cut of 50bps is uncommon, it is not unprecedented in Fed history. However, the action is aggressive enough that the last 50bp cut, aside from the volatile COVID period of 2020, came during the 2008 financial crisis. With the much-debated 25bp vs 50bp question now settled, attention can turn to the far more important question of the overall magnitude of cuts this cycle.”

Gary Siegel contributed to this story.