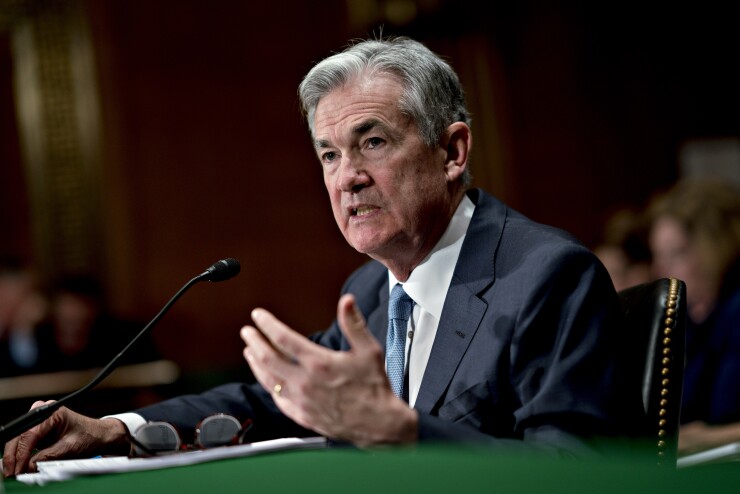

Powell tells Congress Fed needs more confidence before cutting

Federal Reserve Chairman Jerome Powell was repeatedly quizzed about interest rate cuts, banking regulations and the intricacies of the Basel III Endgame proposal by the Senate Committee on Banking, Housing, and Urban Affairs, but he disappointed markets by saying his panel needs “more good data” before it will cut interest rates.

“Inflation has eased notably over the past couple of years but remains above the Committee’s longer-run goal of 2%,” Powell said in his written testimony.

“The Committee has stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2%.”

Bloomberg News

Committee leadership seemed more interested in the Fed’s position on the Basel III Endgame proposal than monetary policy. The proposed and controversial rule change would require banks to hold more capital in their reserve funds. The new regulations could subject municipal bonds to standardized treatment while driving up borrowing costs for municipalities.

Basel III was originally conceived to make banks less prone to failures, but has since become a political

Panel Chairman Sen. Sherrod Brown, D-Ohio backed Basel III. “Strong capital standards are critical for the economy — it’s our way of making sure that if Wall Street’s bets go poorly, investors and executives and shareholders pay for it, not taxpayers.”

Ranking Member Sen. Tim Scott took the other side of the regulation argument.

“I can’t think of a better example of overregulation than parking more capital on the sidelines through Basel III Endgame,” he said. “That proposal itself would cost millions of Americans their chance to own a home, start a small business, and have access to the credit and the capital necessary to make their American Dreams come true.”

Powell attempted to allay fears about the proposal being finalized before all comments and critiques are addressed and hewed back to the Fed’s primary goals.

“The Federal Reserve remains squarely focused on our dual mandate to promote maximum employment and stable prices. Over the past two years, the economy has made considerable progress toward the Federal Reserve’s 2% inflation goal, and labor market conditions have cooled while remaining strong.”

“Our position is that the Fed doesn’t want to cause a recession if they can avoid it and if the data allows, we expect the Federal Reserve to start moving monetary policy from restrictive territory to slightly less restrictive policy from September,” said James Knightley, chief international economist at ING.

Along with other Fed watchers, ING is monitoring core inflation, unemployment, and consumer spending.

“If we are right and the data comes in as we project, we suspect that the Jackson Hole symposium in late August will be used as the venue to give the market the clearest indication on impending policy loosening,” said Knightley.