Issuers to test investor appetite with more than $12B supply

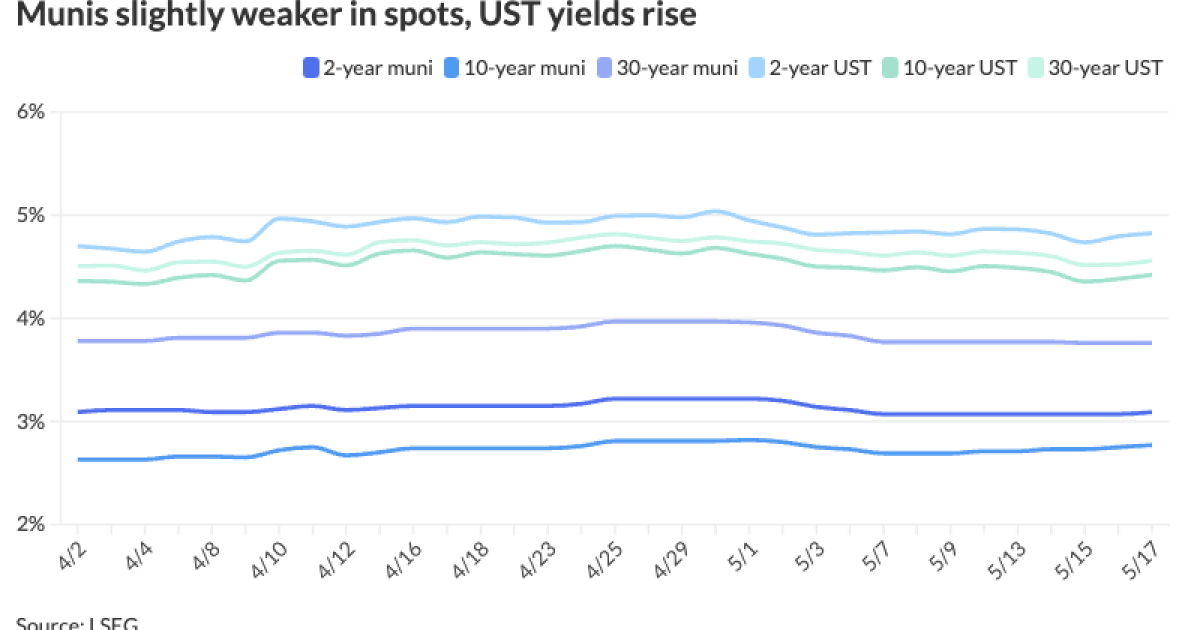

Municipals were steady to slightly weaker in spots ahead of a $12 billion-plus calendar, while U.S. Treasury yields rose and equities were mixed near the close.

There are nearly 30 new-issues over $100 million on tap across the credit spectrum, led by the week’s largest negotiated deal from Harris County, Texas, with $950 million of toll road first lien revenue and refunding bonds. The competitive calendar ticks up with several high-grade names.

“April CPI data did turn out to be somewhat softer, giving bond investors much-needed relief and sending rates market shorts running for cover,” said BofA strategists said in a weekly report.

In the near term, “there should still be quite a bit to go … before the market runs into some meaningful resistance,” they said.

Softer inflation and economic data had led to a UST rally, but “tax-exempts have barely moved, and MMD-UST ratios in the front and the belly of the curve have moved to their highest level since late November, even though it is not really saying much when ratios are in the low 60s, which is well below the long-term average,” according to Barclays PLC.

The two-year muni-to-Treasury ratio Friday was at 64%, the three-year at 64%, the five-year at 63%, the 10-year at 63% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 64%, the five-year at 63%, the 10-year at 64% and the 30-year at 83% at 3:30 p.m.

Overall, the muni market feels “quite heavy” currently despite the lack of investor selling, with “relatively subdued” bid-wanted activity, Barclays strategists said in a weekly report.

“There is definitely some buying apathy at the moment, and, in general, some investor push-back with respect to buying higher-rated names, although there is still enough demand for lower-rated credits, and lower-rated credits have continued outperforming,” they said.

Outside of some “one-off opportunities,” tax-exempts are still rich, Barclays strategists said.

“The market feels heavy, as we really expected a better follow-through after this week’s rally in USTs, and we should not have seen any fund outflows this week,” they said. “Moreover, despite heavy summer redemptions, market technicals might start deteriorating soon.”

The new-issue calendar for next week remains robust with an estimated $12.037 billion on tap — $9.698 billion of negotiated deals and $2.34 billion of competitive ones.

The negotiated calendar is led by Harris County, Texas, with $950 million of toll road first lien revenue and refunding bonds.

Other large deals include the Great Lakes Water Authority, Michigan, with $768 million in two deals, Burbank-Glendale-Pasadena Airport Authority with $736 million and the Texas State University System Board of Regents with $608 million.

The Virginia Public Building Authority leads the competitive calendar with $386 million of public facilities revenue bonds in three series.

Steve McLaughlin, executive director at S&P Global Market Intelligence, noted there is “significant retail enthusiasm in this market, particularly with the decade-long expansion of [separately managed accounts].”

The “notable” supply-demand imbalance usually seen in the summer months of June through August “serves as a favorable factor,” he said.

“Naturally, the effectiveness of amortization schedules plays a crucial role,” McLaughlin said. “Nevertheless, advisors find nominal yields immensely beneficial for utilizing fixed-rate maturities to fulfill their clients’ income requirements and help them get from point A to point B.”

Muni CUSIP requests rise

Municipal CUSIP request volume rose in April on a year-over-year basis, following an increase in March, according to CUSIP Global Services.

For municipal bonds specifically, there was an increase of 5.1% month-over-month but a 1.1% decrease year-over-year.

For the specific category of municipal bond identifier requests, there was an increase of 10.2% month-over-month, although requests are down 2% on a year-over-year basis.

Texas led state-level municipal request volume with a total of 100 new CUSIP requests in April, followed by California (63) and New York (61).

AAA scales

Refinitiv MMD’s scale was cut up two basis points: The one-year was at 3.23% (+2) and 3.09% (+2) in two years. The five-year was at 2.78% (+2), the 10-year at 2.77% (+2) and the 30-year at 3.76% (unch) at 3 p.m.

The ICE AAA yield curve was cut one to three basis points: 3.23% (+1) in 2025 and 3.10% (+2) in 2026. The five-year was at 2.80% (+3), the 10-year was at 2.77% (+3) and the 30-year was at 3.75% (+2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 3.25% (unch) in 2025 and 3.07% (unch) in 2026. The five-year was at 2.76% (+1), the 10-year was at 2.71% (+1) and the 30-year yield was at 3.74% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut up to two basis points: 3.29% (unch) in 2025 and 3.11% (+1) in 2026. The five-year at 2.68% (+1), the 10-year at 2.65% (+2) and the 30-year at 3.79% (+1) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.823% (+3), the three-year was at 4.606% (+3), the five-year at 4.442% (+4), the 10-year at 4.432% (+4), the 20-year at 4.664% (+4) and the 30-year at 4.561% (+4) at 3:30 p.m.

Primary to come

Harris County, Texas, (Aa2//AA/) is set to price Tuesday $950 million of toll road first lien revenue and refunding bonds, Series 2024A, serials 2025-2050. Raymond James.

The Burbank-Glendale-Pasadena Airport Authority (A2/A/A-/) is set to price Wednesday $736.11 million of airport senior revenue bonds, consisting of $32.305 million of non-AMT bonds, Series 2024A, serial 2054; $649 million of AMT bonds, Series 2024B, serials 2031-2044, terms 2049, 2054; and $54.805 million of taxables, Series 2024C, serials 2028-2031. BofA Securities.

The Texas State University System Board of Regents (Aa2//AA/) is set to price Tuesday $607.9 million of Revenue Financing System revenue and refunding bonds, Series 2024, serials 2025-2044, terms 2049, 2054. Wells Fargo.

The Southern California Public Power Authority (A2///) is set to price next week $588.69 million of Clean Energy Project revenue bonds, Series 2024A. Goldman Sachs.

The authority (Aa2//AA-/) is also set to price Tuesday $186.955 million of Apex Power Project refunding revenue bonds, 2024 Series A. J.P. Morgan.

The California Enterprise Development Authority (Aa3/AA-//) is set to price Wednesday $519.845 million of Riverside County – Mead Valley Wellness Village Project lease revenue bonds, $429.845 million of Series 2024A and $90 million of Series 2024B. Morgan Stanley.

Austin, Texas, (Aa2/AA/AA-/) is set to price Tuesday $455.695 million of water and wastewater system revenue refunding and improvement bonds, Series 2024, serials 2024-2044, terms 2049, 2053. Ramirez.

The Great Lakes Water Authority, Michigan, is set to price Tuesday $385.585 million of sewage disposal system revenue refunding bonds, consisting of $345.435 million of senior lien bonds (Aa3/AA-/AA-/), Series 2024A, serials 2025-2033, and $40.150 million of second lien bonds (A1/A+/A+/), Series 2024B, serials 2025-2029, 2032, 2034-2035. Siebert Williams Shank.

The authority is set to price Tuesday $382.745 million of water supply system revenue refunding bonds, consisting of of $345.75 million of senior lien bonds (Aa3/AA-/AA-/), Series 2024A, serials 2025-2035, 2037, and $35.995 million of second lien bonds (A1/A+/A+/), Series 2024B, serials 2025-2027, 2034, 2036. Siebert Williams Shank.

The Edmonds School District No. 15, Washington, (Aaa///) is set to price Wednesday $289.815 million of unlimited tax GO and refunding bonds, Series 2024. Piper Sandler.

The Illinois Finance Authority (Aa3/AA-//) is set to price Thursday $285.895 million of Endeavor Health Credit Group revenue refunding bonds, Series 2024A. BofA Securities.

The Florida Housing Finance Corp. (Aaa///) is set to price Wednesday $250 million of homeowner mortgage revenue bonds, consisting of $100 million of non-AMT bonds, 2024 Series 3, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2055, and $150 million of taxables, 2024 Series 4, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2055. BofA Securities.

The corporation is also set to price Wednesday $146.64 million of SFP – Tampa I – The Henry Project student housing revenue bonds, consisting of $104.79 million of tax-exempt senior bonds (A-1 //BB+/), Series 2024A-1, terms 2044, 2054, 2059; $13.15 million of taxable senior bonds (A-2 //BB+/), Series 2024A-2, term 2037; and $28.7 million of non-rated tax-exempt subordinate bonds, Series 2024B, serial 2059. RBC Capital Markets.

Corpus Christi, Texas, (/AA-/AA-/) is set to price Thursday $244.765 million of utility system senior lien revenue improvement and refunding bonds, Series 2024, serials 2025-2044, terms 2049, 2054. Ramirez.

The Virginia Electric and Power Company (A2/BBB+//) is set to price Tuesday $242.5 million, consisting of $37.5 million of Series A, term 2035; $100 million of Series B, term 2041 and $105 million of Series C, term 2040. PNC Capital Markets.

The Iowa Finance Authority (Aaa/AAA//) is set to price Tuesday $202.95 million of green State Revolving Fund revenue bonds, Series 2024A. Morgan Stanley.

The Astoria Hospital Facilities Authority, Oregon, (/BBB/BBB+/) is set to price Wednesday $200 million of Columbia Memorial Hospital Project revenue bonds, Series 2024, serials 2030-2044, terms 2049, 2054. BofA Securities.

The Port of Beaumont Navigation District, Texas, is set to price $199.695 million of non-rated Jefferson Gulf Coast Energy Project Dock and Wharf Facility revenue bonds, Series 2024B. Morgan Stanley.

The Wisconsin Housing and Economic Development Authority (Aa2/AA+//) is set to price Tuesday $190 million of non-AMT social home ownership revenue bonds, 2024 Series B, serials 2025-2036, terms 2039, 2044, 2051, 2055. RBC Capital Markets.

Glendale, Arizona, (/AA+/AA/) is set to price Tuesday $169.59 million of senior excise tax revenue and revenue refunding obligations, Series 2024, serials 2026-2038. RBC Capital Markets.

The Trustees of Indiana University (Aaa/AAA//) is set to price Tuesday $102.05 million of Indiana University consolidated revenue bonds, Series 2024A. Goldman Sachs.

The Los Angeles Community College District (Aaa/AA+//) is set to price Tuesday $100.08 million of 2022 Election GOs, consisting $100 million of taxables, serials 2024-2027, and $80,000 million of tax-exempts, serials 2024-2039. BofA Securities.

Ohio (Aa3//AA-/) is set to price Tuesday $100 million of Children’s Hospital Medical Center of Akron hospital facilities revenue bonds. Goldman Sachs.

Competitive

Wake County, North Carolina, (Aaa/AAA/AAA/) is set to sell $66.14 million of GO public improvement bonds, Series 2024A, at 11 a.m. Tuesday, and $164.38 million of GO refunding bonds, Series 2024B, at 10:30 a.m. Tuesday.

Fort Worth, Texas, (/AA/AA/) is set to sell $16.55 million of tax notes at 10:30 a.m. Tuesday and $156.315 million of general purpose bonds at 10:30 a.m. Tuesday.

Loudoun County, Virginia, (Aaa/AAA/AAA/) is set to sell $201.655 million of GO public improvement bonds, Series 2024A, at 11:15 a.m. Tuesday.

The Virginia Public Building Authority is set to sell $220.66 million of public facilities revenue bonds, Series 2024A, at 10:15 a.m. Tuesday; $135.13 million of public facilities revenue refunding bonds, Series 2024B, at 10:45 a.m. Tuesday; and $30.12 million of taxable public facilities revenue bonds, Series 2024C, at 11:15 a.m. Tuesday.

Clark County, Nevada, is set to sell $206.895 million of highway revenue improvement and refunding bonds, Series 2024, at 11:30 a.m. Wednesday.

Fort Worth, Texas, is set to sell $150 million of water and sewer system revenue bonds at 10:30 a.m. Wednesday.