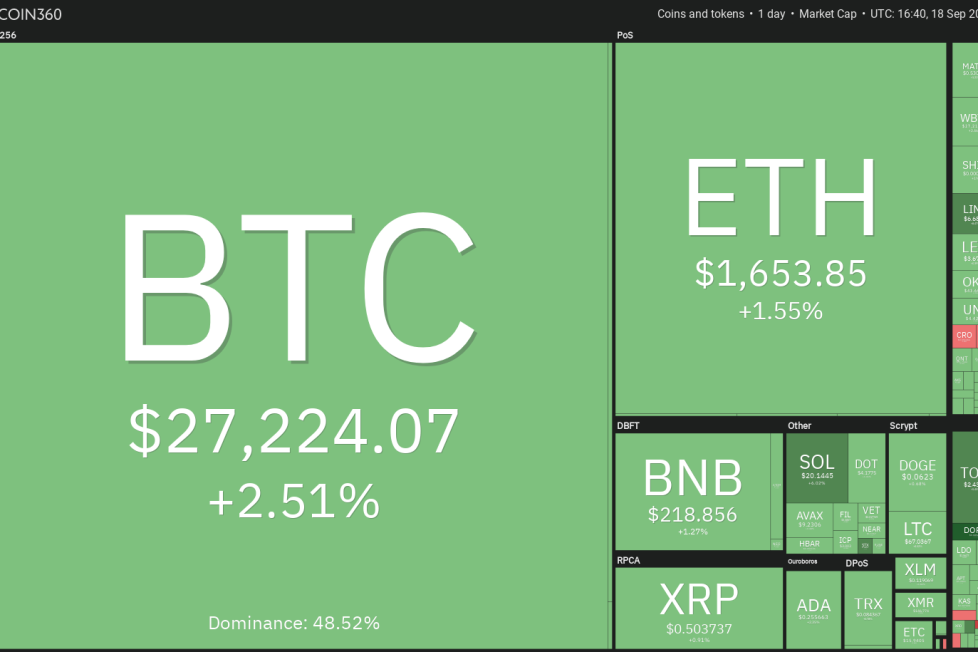

Price analysis 9/18: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE, TON, SOL

The failure of the bears to sink Bitcoin’s price below $25,000 support ignited buying interest last week. The positive momentum picked up further at the start of the new week, and buyers are trying to sustain Bitcoin’s (

Dogecoin (DOGE) has been stuck between the 20-day EMA ($0.06) and the horizontal support at $0.06 for the past few days.

Generally, a squeeze in volatility is followed by a range expansion. If the DOGE/USDT pair soars and closes above the 20-day EMA, it will suggest that bulls are attempting a comeback. The pair could then rally to $0.07. Buyers will have to overcome this roadblock to start an up move to $0.08.

This positive view will be invalidated if the price turns down and dives below the $0.06 support. That could pull the price down to the next support at $0.055. The bulls are expected to guard this level with vigor.

The long wick on Toncoin’s (TON) Sept. 16 and 17 candlesticks shows that traders are booking profits near the overhead resistance at $2.59.

The overbought level on the RSI suggests a possible correction or range formation in the near term. However, the bulls have not given up and are again trying to propel the TON price above $2.59. If they can pull it off, TON/USDT could pick up momentum and skyrocket to $3.

The important support to watch for on the downside is $2.25. If this level gives way, the pair could start a deeper correction to the next support at $2.07.

After trading near the 20-day EMA ($19.47) for the past few days, Solana (SOL) broke above the resistance on Sept. 18.

The 20-day EMA is flattening out and the RSI is near the midpoint, indicating that the bears may be losing their grip. Buyers will try to cement their position further by pushing the price to the overhead resistance at $22.30. This level is likely to attract sellers.

If the bulls fail to hold the price above the 20-day EMA, it will suggest that bears are selling at higher levels. The first support on the downside is $18.50, and if this level is violated, SOL risks descending toward the next major support at $17.33.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.