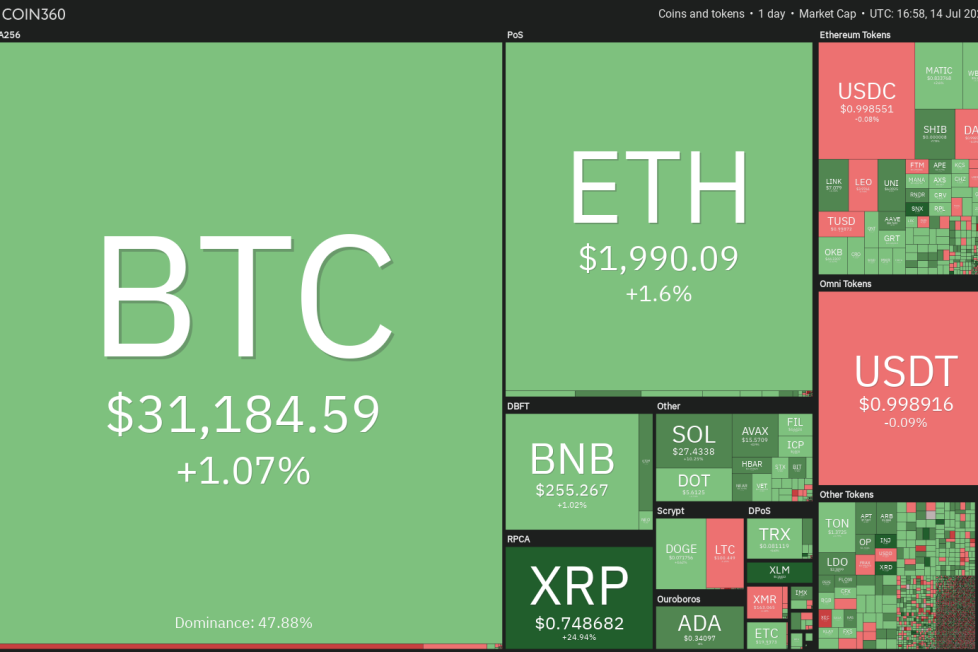

Price analysis 7/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, LTC, MATIC, DOT

Ripple Labs’ victory in the case against the United States Securities and Exchange Commission gives a

The bulls successfully held the 20-day EMA ($96) on July 12, indicating that the sentiment has turned positive in Litecoin (LTC) and traders are buying on dips.

The rally has reached near $106, where the bulls are likely to face solid resistance. If buyers do not give up much ground from the current levels, it will increase the likelihood of a break above $106. The LTC/USDT pair could then retest the important resistance of $115. If this level is scaled, the pair may rally to $134.

This positive view will invalidate in the near term if the price turns down and closes below the 20-day EMA. The pair may then slump to the 50-day SMA ($90).

The bears tried to pull Polygon (MATIC) back below the breakout level of $0.72 on July 12, but the bulls held their ground.

That attracted huge buying on July 13, which propelled the price to $0.89, just shy of the pattern target of $0.94. The moving averages are on the verge of a bullish crossover and the RSI is near the overbought zone, indicating that bulls are in control. The up move could reach the psychological level of $1, where the bears are expected to mount a stiff resistance.

The important support to watch on the downside is the 20-day EMA ($0.72). A break and close below it will suggest that the bullish momentum is weakening.

Polkadot (DOT) rebounded off the moving averages on July 13 and reached the overhead resistance at $5.64 on July 14.

The 20-day EMA ($5.20) has turned up slightly and the RSI has jumped into positive territory, indicating that bulls have the upper hand. The DOT/USDT pair will complete a bullish inverse head-and-shoulders pattern on a break and close above $5.64. That could start a new up move, which has a pattern target of $7.06.

If bears want to prevent the rally, they will have to drag and sustain the price back below $5.64. That may keep the pair range-bound between the 50-day SMA ($5.05) and $5.64 for some time.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.