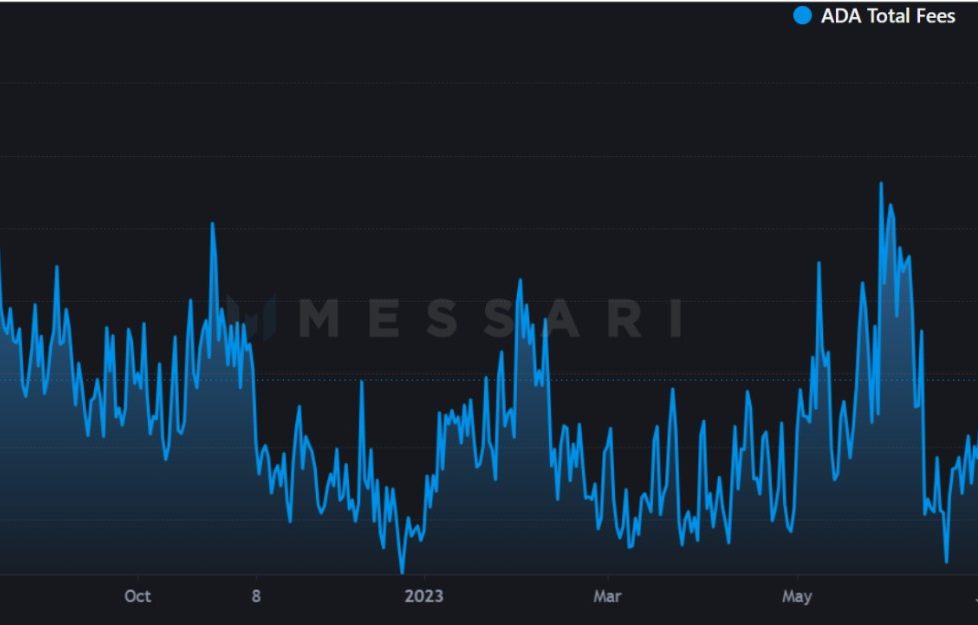

Cardano network activity and ADA’s oversold price action hint at a powerful breakout

Caradano’s native gas-paying token,

On-chain analytics firm Santiment recorded a “high amount of sales at lower prices” in the first week of July as prices rebounded toward the $0.30 resistance level.

Santiment analysts added that the levels of profit-booking exhibited oversold conditions, “making the chances of bounces increase.”

The funding rate data for perpetual swap contracts from CoinGlass shows that most traders held short positions on ADA, betting on a downturn after the regulatory crackdown. The massive sell-offs and negative sentiment can give rise to a contrarian price rally in the short to medium term.

Technically, The ADA/USD pair has formed higher lows after bottoming at around $0.21 in June, suggesting that buyers are scooping the token on dips. A confirmation of the positive trend will come if buyers are able to flip the horizontal resistance level at $0.30 into support.

The ADA/BTC pair shows signs of a potential bottom, as its weekly relative strength index indicator fell into oversold territory and the pair tested the long-term support and resistance level of 0.00000956 Bitcoin (BTC).

If buyers are successful, the pair looks primed for a 60% price surge toward 0.00001548 BTC support.

ADA has been facing headwinds due to the SEC’s lawsuit, delistings from U.S.-based trading apps and negative sentiment, but there are signs that the network is still making progress. If the technicals continue to improve, supported by on-chain growth, ADA could be poised for a positive recovery in the future.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.