3 key Ether price metrics point to growing resistance at the $1,750 level

Ether’s price plunged 7% between June 14 and June 15, reaching its lowest level in three months and impacting investors’ view that the altcoin was en-route to turning $2,000 to support.

It is worth noting that the $1,620 bottom represents a $196 billion market capitalization for Ether (

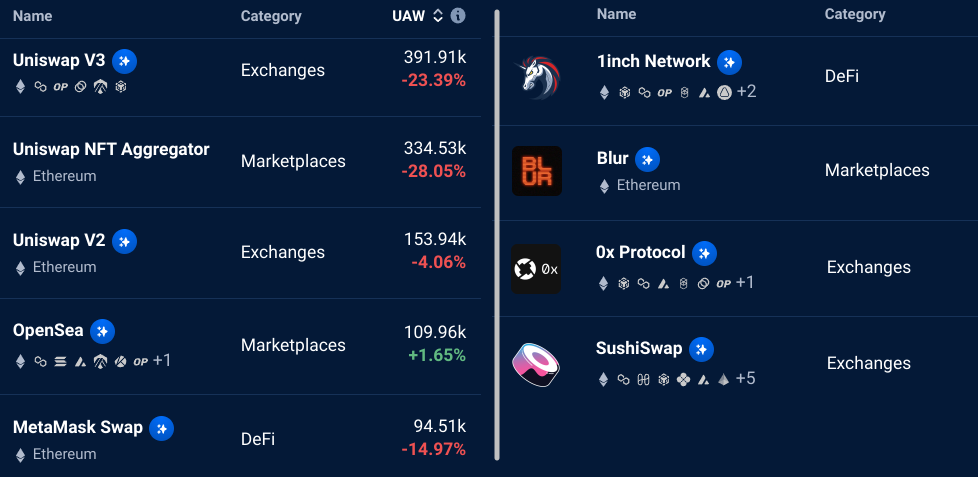

Investors tend to focus solely on short-term price movements and forget that Ether’s price is up 37% year-to-date in 2023. Moreover, by relying too much on Ethereum’s $24 billion in TVL, traders might have missed the signals of weakening demand for DApp use.

For now, bears have the upper hand considering the ETH derivatives metrics, so a retest of the $1,560 support is the most likely outcome. That does not mean that the 2023 gains are at risk, but until the regulatory FUD — fear, uncertainty and doubt — dissipates, bulls will have a hard time moving Ether above the $1,750 resistance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.