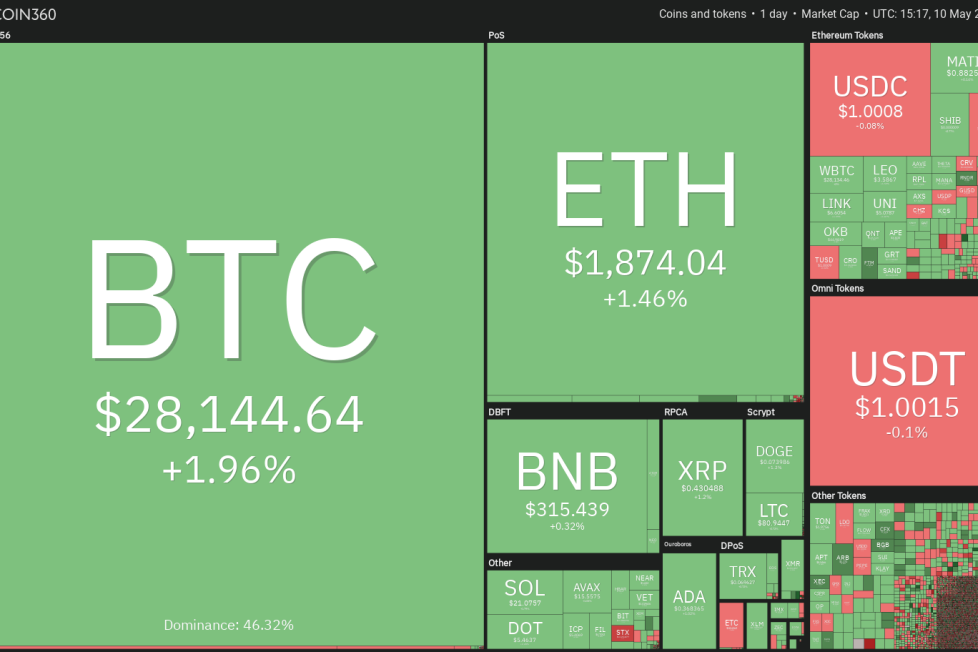

Price analysis 5/10: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

The United States consumer price index (CPI) rose 4.9% annually, which was slightly less than estimates of a 5% increase. The CPI’s monthly rise of 0.4% in April was

Solana (SOL) turned down from the downtrend line on May 6 and fell to the strong support level of $19.85 on May 8.

The bulls are trying to start a recovery, but the rebound lacks conviction. If Solana’s price turns down from the current level and plunges below $19.85, the SOL/USDT pair may fall to $18.70. This level may again act as strong support.

If bulls want to prevent a decline, they will have to quickly drive the price above the downtrend line. If they manage to do that, SOL’s price could rise to $24 and subsequently to the overhead resistance level of $27.12.

The bulls are trying to protect the strong support level of $5.15 as seen from the long tail on Polkadot’s (DOT) May 8 candlestick.

The recovery is likely to face stiff resistance at the 20-day EMA ($5.77), as the bears have been guarding this level with vigor. If the price turns down from the current level or the 20-day EMA, the bears will make another attempt to sink the DOT/USDT pair below $5.15. If they can pull it off, Polkadot’s price risks a drop to $4.50.

Contrarily, if the relief rally pierces the 20-day EMA, DOT’s price may rise to the 50-day simple moving average (SMA) at $6.10 and later reach the downtrend line. A break and close above this level will suggest that the bulls are on a comeback.

Litecoin (LTC) rebounded off the crucial support level of $75 on May 8, indicating that the bulls are trying to arrest the decline at this level.

A downsloping 20-day EMA ($86) and an RSI in negative territory indicate that bears are in command. Any recovery attempt is likely to face selling at the 20-day EMA. If Litecoin’s price turns down from this level, it will increase the likelihood of a break below $75. If that happens, the LTC/USDT pair could tumble to $65.

Contrary to this assumption, if bulls drive LTC’s price above the 20-day EMA, it will suggest that bearish pressure is reducing. The pair may first recover to the 50-day SMA ($90) and thereafter dash toward $96.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.