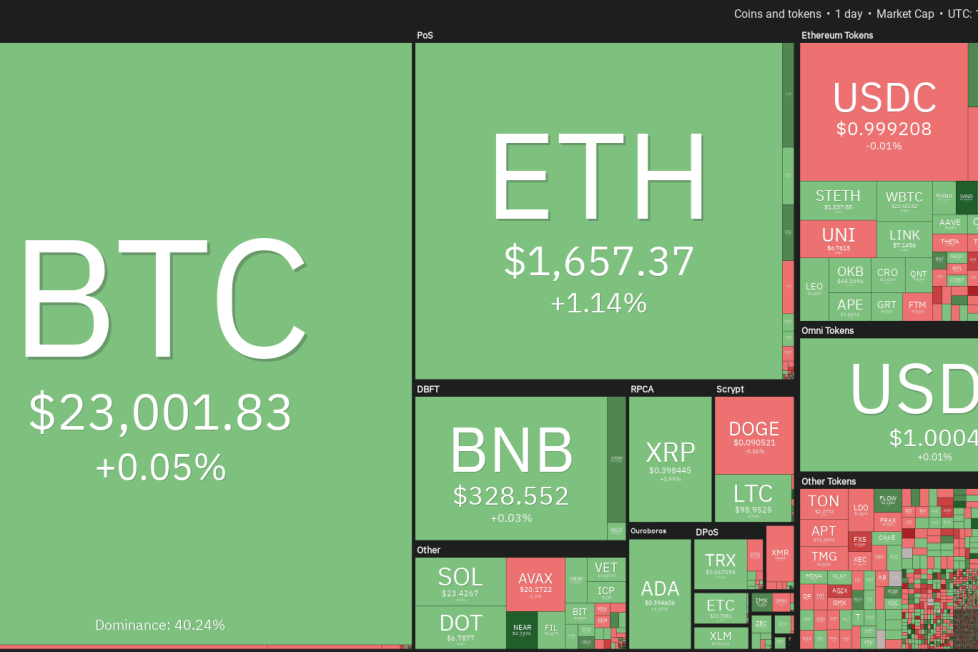

Price analysis 2/8: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, AVAX

United States Federal Reserve Chairman Jerome Powell said on Feb. 7 that the “disinflationary process, the process of getting inflation down,” has started but it is still in its very early stages.

He cautioned that strong data would be met with more rate hikes. Though his

In an uptrend, the bulls usually buy the dip to the 20-day EMA as it offers a low-risk trading opportunity. Litecoin (LTC) bounced off the 20-day EMA ($94) on Feb. 7, signaling that the uptrend remains intact.

There is a minor hurdle at $102.50 but if that is crossed, buyers will try to propel the LTC/USDT pair to $107. This level may again act as a roadblock but if buyers do not allow the price to dip below the 20-day EMA, the prospects of a rally to $115 increase.

Alternatively, if bears want to gain the upper hand, they will have to sink the price below the 20-day EMA. If they manage to do that, several stop losses may get triggered. The pair could then start a deeper correction to the 50-day SMA ($83).

Polkadot’s (DOT) retest of the breakout level was successfully defended by the bulls on Feb. 7. This shows that buyers are trying to flip the resistance line into support.

The bears are offering stiff resistance near $7. But the rising 20-day EMA ($6.41) suggests that the sentiment remains positive. If buyers drive the price above $7.12, the DOT/USDT pair could travel to $8, which is likely to again act as a strong hurdle.

The first sign of weakness will be a break and close below the 20-day EMA. That may encourage short-term traders to book profits and open the doors for a possible decline to $6 and then to the 50-day SMA ($5.52).

Avalanche (AVAX) bounced off the 20-day EMA ($19.28) on Feb. 7, indicating that lower levels continue to attract buyers. However, the bulls are struggling to sustain the higher levels, signaling that bears are selling on rallies.

The AVAX/USDT pair is stuck between the 20-day EMA on the downside and $22 on the upside. Usually, a consolidation near an overhead resistance is a positive sign as it shows that bulls are not rushing to the exit. If buyers drive the price above $22, the pair may start its journey toward $30.

Contrary to this assumption, if the price breaks back below the resistance line, it will suggest that the bulls have given up and are booking profits. The pair could then slide to the 50-day SMA ($15.61).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.