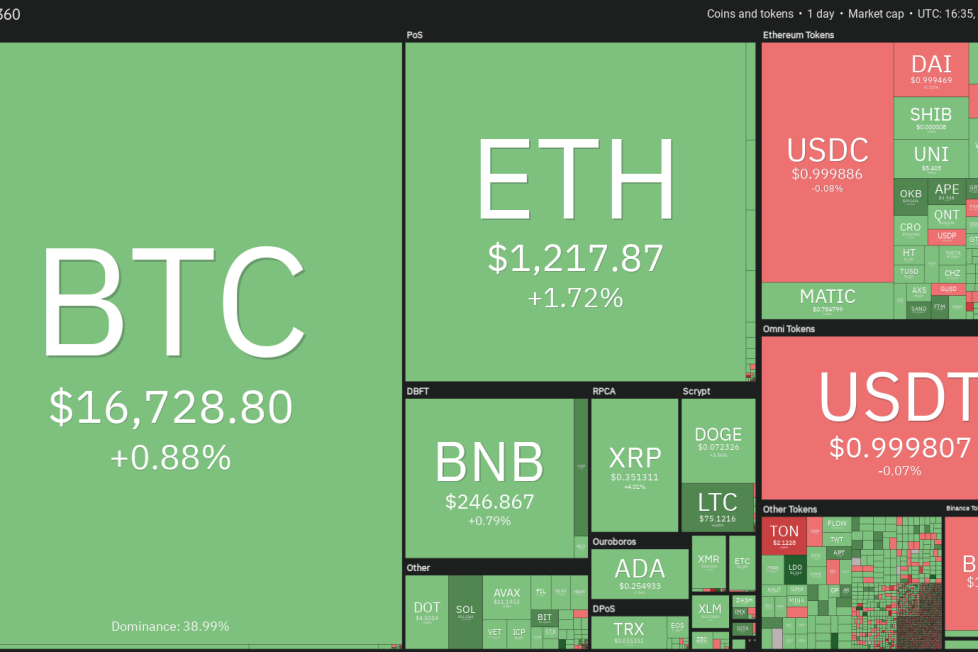

Price analysis 1/2: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, LTC

The S&P 500 index (SPX) fell 19.4% and the Nasdaq nosedived 33.1% in 2022, their worst performances since 2008. The crypto markets also had a horrendous year, with Bitcoin (

Cardano (ADA) has started a recovery and the price is nearing the 20-day EMA ($0.26). The positive divergence on the RSI suggests that the selling pressure could be reducing.

The 20-day EMA is an important level to keep an eye on. If buyers overcome this obstacle, the ADA/USDT pair could rise to the breakdown level of $0.29. If this level is also scaled, the pair could touch the downtrend line.

Contrarily, if the price once again turns down from the 20-day EMA, it will suggest that bears are active at higher levels. The pair could then drop to the support line where the buyers may step in to stop the decline.

Polygon (MATIC) fell below $0.75 on Dec. 30 but the bears could not capitalize on the advantage and pull the price to the critical support at $0.69.

The bulls are trying to start a relief rally, which could face selling at the moving averages. If the price turns down from this resistance, it will suggest that higher levels are attracting selling by the bears. That could increase the likelihood of a drop to $0.69.

On the other hand, if bulls drive the price above the moving averages, the MATIC/USDT pair could rally to $0.97. This level may again behave as a strong barrier but if bulls surpass it, the next stop will likely be $1.05.

Litecoin (LTC) soared above the moving averages and the overhead resistance at $75 on Jan. 3. This indicates that buyers are attempting to take control.

If the price sustains above $75, the LTC/USDT pair could rally to $85. This level may act as a minor obstacle but if crossed, the pair could pick up pace and skyrocket to the psychologically vital level of $100.

If bulls fail to sustain the price above $75, the pair could drop to the moving averages. If the price rebounds off this support, the possibility of a break above the overhead resistance increases. The bears will be at an advantage if the price turns down and falls below the moving averages.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Market data is provided by HitBTC exchange.