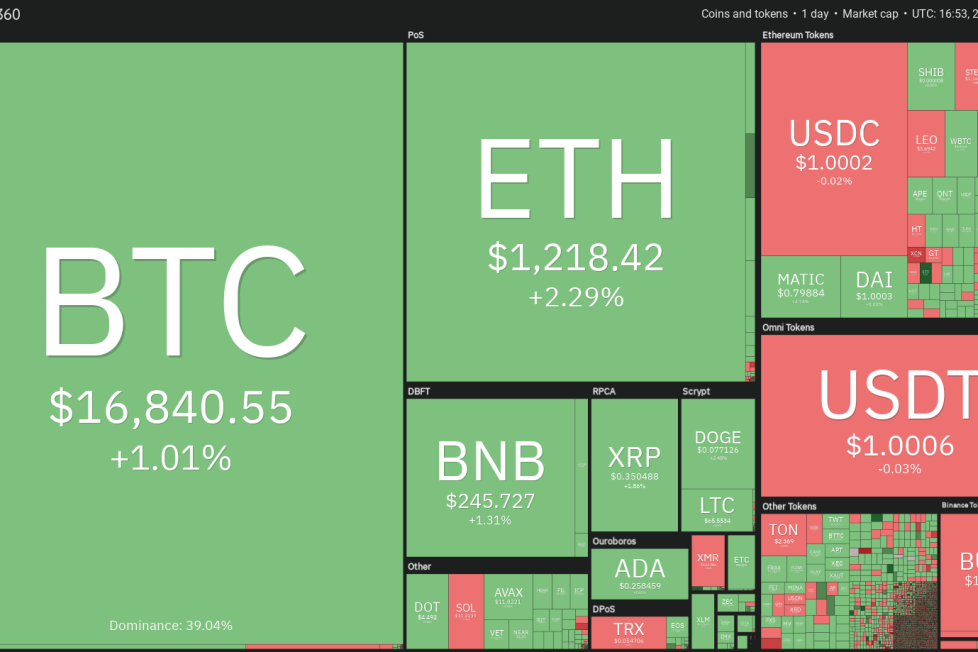

Price analysis 12/23: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Bitcoin (

Polkadot‘s DOT (DOT) slipped below the $4.40 support on Dec. 22, but the bears could not sustain the lower levels, as seen from the long tail on the candlestick. This indicates buying at lower levels.

The bulls will have to sustain their buying and push the price above the 20-day EMA ($4.92) to indicate strength. The DOT/USDT pair could then move up to the 50-day SMA ($5.45) and later attempt a rally to the downtrend line.

On the contrary, if the price turns down and breaks below $4.37, it will suggest that the downtrend remains intact. The pair could then drop to $4. The downsloping moving averages and the RSI near the oversold area suggest that bears are in command.

Litecoin’s (LTC) recovery is facing resistance near $67. The failure of the bulls to push the price to the moving averages shows that bears are selling on every minor rally.

The moving averages are on the verge of a bearish crossover and the RSI is in the negative zone, indicating an advantage for bears. If the price turns down and breaches the support at $61, the LTC/USDT pair could plummet to $56.

If bulls want to invalidate this negative view, they will have to push and sustain the price above the moving averages. The pair could then attempt a rally to $75 where the bears may again mount a strong resistance.

Uniswap‘s UNI (UNI) is trading in a tight range between the support line of the symmetrical triangle and $5.50. This suggests that bulls are buying the dips but have not been able to clear the overhead hurdle at $5.50.

The downsloping moving averages and the RSI in the negative territory indicate an upper hand to the bears. If the price turns down and breaks below the triangle, the UNI/USDT pair could plunge to $4.60.

Alternatively, if the price turns up and breaks above $5.50, the pair could rise to the 50-day SMA ($5.84). This level may again act as a resistance but if bulls push the price above it, the pair could reach the resistance line.

Market data is provided by the HitBTC exchange.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.