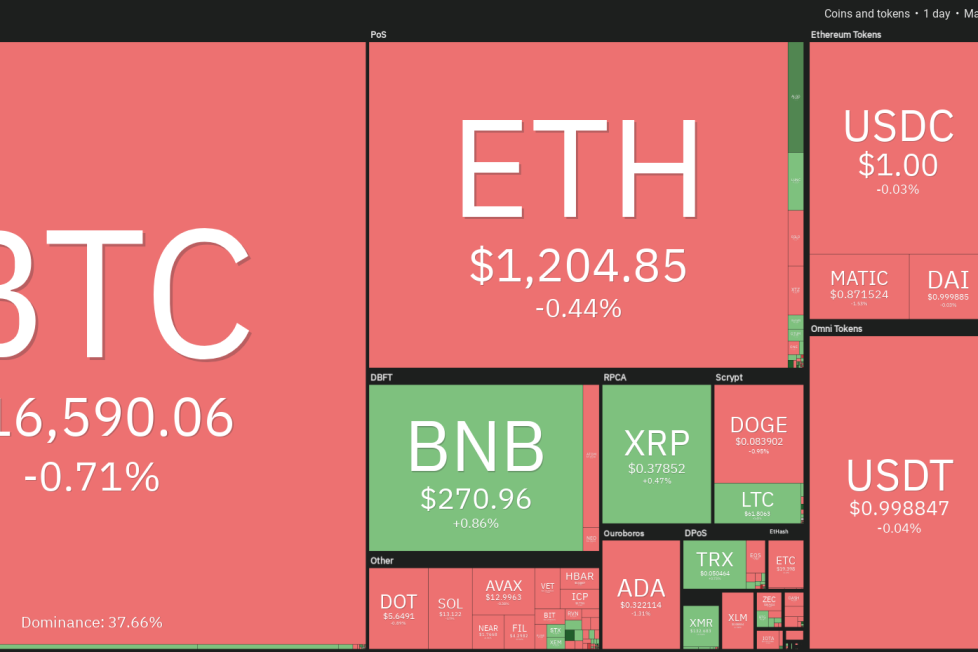

Price analysis 11/18: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

The sentiment across the cryptocurrency ecosystem remains fragile as market participants assess the impact of the FTX crisis on various businesses within and outside of the crypto sector. Trading firm QCP Capital said in its latest circular on Telegram that crypto assets

The price action of the past few days has formed a pennant, which generally acts as a continuation pattern. The downsloping moving averages and the RSI in the negative territory indicate that sellers have the edge in Polkadot (DOT).

If the price turns down and breaks below the pennant, the selling could pick up. The DOT/USDT pair could start the next leg of the downtrend on a break below $5.32. The next support on the downside is at $4.32.

Conversely, if the price continues higher and breaks above the pennant, it will invalidate the bearish setup. The pair could then rise to the 50-day SMA of $6.22. A break and close above this level could suggest that the short-term downturn could be over.

Uniswap (UNI) turned down from the 50-day SMA of $6.43 on Nov. 16, but the bulls are attempting to form a higher low at $5.66.

The bulls will have to push and sustain the price above the 50-day SMA to gain the upper hand. If they manage to do that, the UNI/USDT pair could attempt a rally to $7.36 and thereafter to $7.79.

The long wick on the Nov. 18 candlestick shows that the bears are defending the moving averages. The downsloping 20-day EMA of $6.20 and the RSI just below the midpoint suggest that the bears are at an advantage. A break and close below $5.66 may clear the path for a retest of $5.14.

Litecoin (LTC) broke and closed above the 20-day EMA of $59 on Nov. 17 and the RSI jumped into positive territory, indicating that the bulls have a slight edge.

The up-move is likely to face stiff resistance at $65. If the price turns down from this level, the LTC/USDT pair could again drop toward the moving averages.

Contrary to this assumption, if buyers drive and sustain the price above $65, the bullish momentum could pick up and the pair could attempt a rally to the overhead resistance at $75.

The bears are expected to defend this level with all their might. If the price turns down from $75, it will suggest that the pair may extend its stay inside the $46 to $75 range for a few more days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.